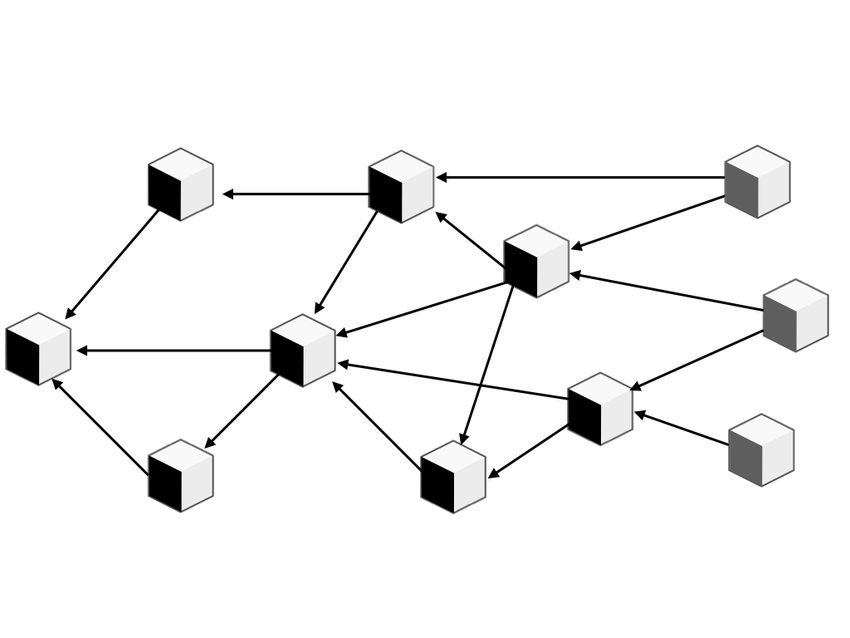

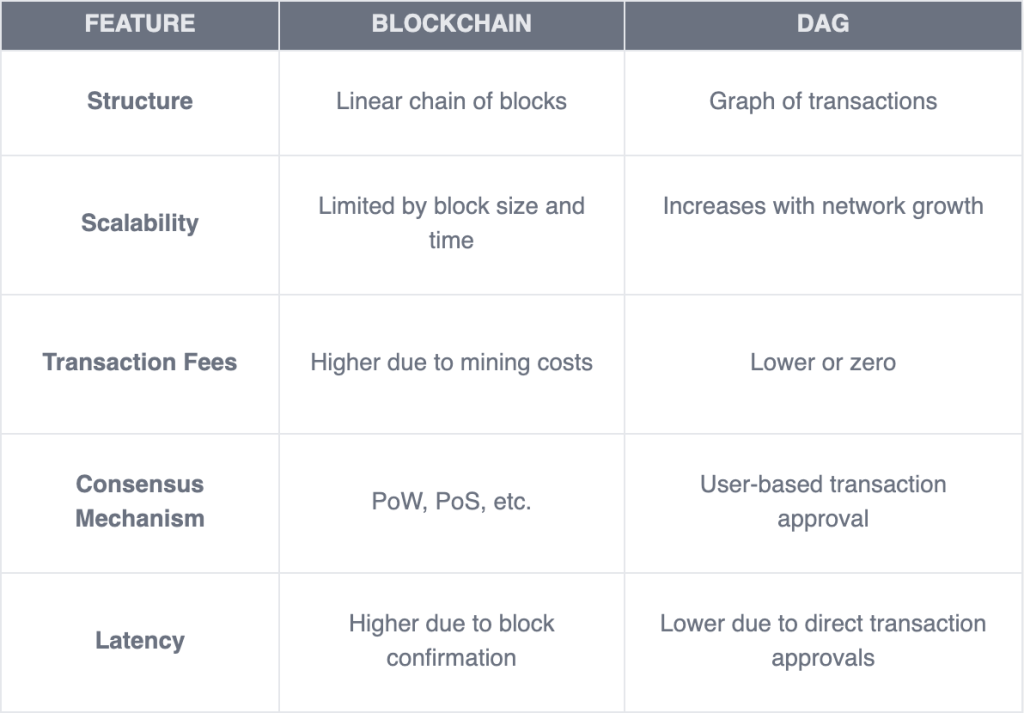

Unlike traditional blockchain networks that rely on a linear chain of blocks, the Directed Acyclic Graph (DAG) framework represents each transaction as a node, allowing transactions to reference multiple previous transactions as their parents. This approach enables parallel processing of transactions, significantly enhancing the network’s scalability.

Directed Acyclic Graph (DAG)-based ledgers and their associated consensus algorithms are emerging as promising technologies for the Internet of Things (IoT). Unlike Proof-of-Work (PoW) and Proof-of-Stake (PoS) mechanisms commonly used in blockchain, the consensus process built on a DAG structure (referred to as DAG consensus) addresses several limitations, including high resource consumption, high transaction fees, low transaction throughput and long confirmation delays.

The “Economy of Edge” (EoE) or “Economy of Things” (EoT) represents a burgeoning ecosystem where devices, systems and services autonomously transact and interact, enabled by advancements in the Internet of Things (IoT). As EoE grows, the need for efficient, scalable and secure transaction mechanisms becomes paramount. Directed Acyclic Graphs (DAGs) have emerged as a promising technology in this space, potentially reshaping the future of EoE.

Understanding Directed Acyclic Graphs (DAGs)

What is a DAG?

A DAG, or Directed Acyclic Graph, is a data structure in which nodes are directionally connected to each other without forming a closed loop. In the context of digital transactions, DAG structures facilitate decentralized and distributed networks where transactions are interconnected in a graph-like manner, as opposed to the linear chains used in traditional blockchains.

Key Characteristics:

- Scalability: Higher transaction throughput as the network grows.

- Decentralization: Users validate each other’s transactions, eliminating the need for miners.

- Efficiency: Faster and more cost-effective transactions due to reduced overhead.

The cost of transactions is a significant factor in EoE, where microtransactions are frequent. Blockchain networks often incur high transaction fees due to mining and block validation costs. DAG-based networks, however, can offer low to zero transaction fees, as there are no miners and transactions are validated by users themselves. This reduction in costs can make a wide range of microtransactions economically viable.

The integration of Directed Acyclic Graph (DAG) technology within Decentralized Physical Infrastructure Networks (DePIN) holds significant promise due to its scalability, efficiency and suitability for real-time processing. As DePIN continues to evolve, DAG is likely to play a pivotal role in enabling the next generation of decentralized infrastructure solutions, making them more robust, scalable and energy-efficient.

The consensus mechanisms used in traditional cryptocurrencies (e.g., Proof of Work for Bitcoin transactions) are not suitable for micropayments, especially when performed by resource-constrained devices. This unsuitability arises from issues such as scalability, transaction fees and block confirmation times. As a result, transferring small amounts of money is still not economically feasible, which limits the practicality of streaming money as a use case.

However, Directed Acyclic Graph (DAG) technology addresses these issues effectively. DAG’s parallel processing capabilities allow for higher transaction throughput and faster confirmation times, making it more scalable. Additionally, DAG systems typically have low to zero transaction fees, which is crucial for enabling cost-effective micropayments. This efficiency makes DAG well-suited for resource-constrained devices, facilitating the transfer of small amounts of money and enhancing the feasibility of Economy of Edge (EOE).

Combining the best elements of blockchain and DAG technologies to form a distributed ledger technology (DLT) that, simultaneously achieves enterprise-grade scalability, consistency, and decentralization. What enterprises have been demanding from the blockchain space for years — predictable transaction fees and stable, low-volatility token prices.

This innovative approach not only addresses longstanding challenges of scalability, security, and interoperability but also paves the way for unprecedented efficiency and decentralization. As we continue to advance in this field, the synergy between DAG and edge computing will undoubtedly be a game changer, driving the next generation of technological innovation and enterprise solutions.